Why do Appraisals Come in Low?

People frequently want to know the likelihood that a house will appraise when they buy or sell a house. This prompts the question: Why do appraisals come in low?

Figures from the larger market do provide some general perspective, even if the answer relies on the scenario, including whether the home was priced appropriately and how quickly values are rising in their neighborhood.

While market conditions can affect how frequently home appraisals are low, research by Fannie Mae indicates that in a balanced market, about 8% of appraisals are below the contract price.

According to Fannie Mae, low appraisals are more likely in markets where bidding wars are more frequent, when prices increase quickly, or when there aren’t enough comparable sales.

With the help of five real estate professionals, we’ll delve into why your appraisal might be poor.

Here’s a preview of what’s to come:

- Volatile Markets May Increase The Odds Of A Low Appraisal

- Bidding Wars Can Lead To Higher Sales Prices

- Sales Information Is Delayed In Fast-rising Markets

- What Other Elements Might Result In A Low Appraisal?

- Data Discrepancies

- Home Improvements Didn’t Increase The Value As Much As Expected

- The Appraiser Was Under Time Constraints

- The Appraiser Lacks Local Expertise

- Your Home Was Priced Too High

- How To Challenge An Appraisal

- The Bottom Line

- Download the E-Book

Volatile Markets may increase the odds of a low appraisal

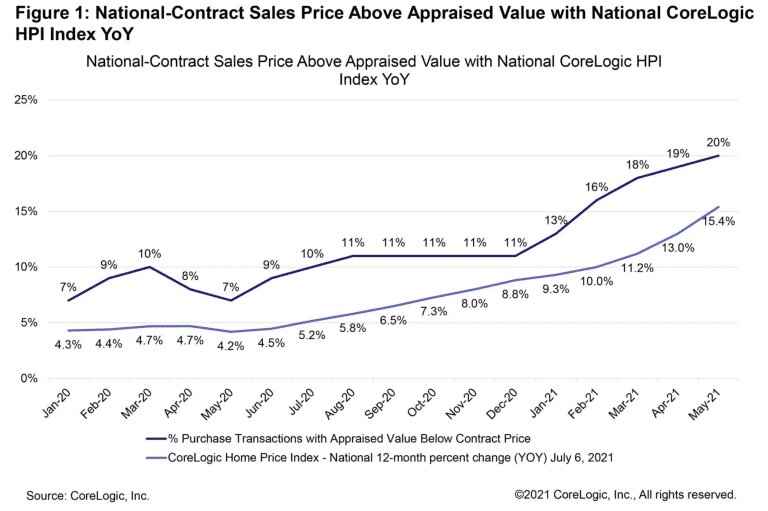

A contract price that was more than the home’s appraised worth was used in 7% of homes sold in May 2020, according to analytics and data service firm CoreLogic.

By 2021, that percentage had increased to 20%, or one in every five residences.

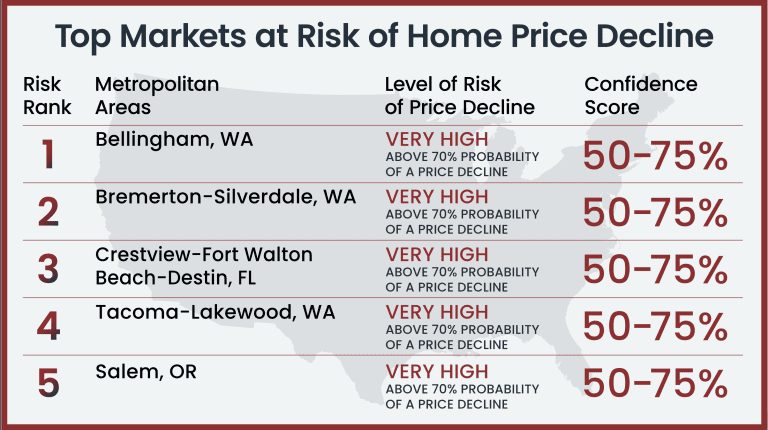

Low appraisals will become somewhat less prevalent moving into 2023 thanks to the recent slump in the property market, which was sparked by rising interest rates and high inflation.

Let’s examine a few elements that could result in a low assessment in these market circumstances.

Bidding Wars can lead to higher sales prices

In a seller’s market, bidders contend for a small number of homes and frequently engage in bidding wars that raise sale prices above those of comparable previous transactions.

Since appraisers base their estimates on comparable sales, they can find it difficult to defend a sale price greater than that of recently sold properties that are like-sized.

Sales information is delayed in fast-rising markets

Lagging sales data might make it challenging for appraisers to understand current market demand in fast-moving sectors.

In June 2022, when the housing market peaked, it took a median of 30 days to close on a home, according to a National Association of Realtors® poll.

It has been 30 days since the buyer and seller agreed on the price by the time the house closes and the appraiser can use the sale as a comparable sale to back up a valuation.

In the interim, comparable residences that are more recent can fetch a higher price.

Analyzing the relationship between rising sale prices and the proportion of low assessments will reveal proof of this phenomenon.

Freddie Mac’s House Price Index showed a 4.49% increase from the prior year in January 2020, when 7% of properties sold for more than the appraised value.

Home prices had increased by 17.81% by May 2021, when 20% of properties sold for more than their appraised worth.

Low evaluations are substantially less frequent in the slower 2023 market.

What other elements might result in a low appraisal?

Other factors, besides market conditions, can cause an assessment to come in lower than anticipated.

Below, our industry experts give a few explanations for why you might come upon a low value.

Data Discrepancies

You might be able to challenge the report if the appraiser committed “egregious errors,” according to Jacobs.

Jacobs emphasizes the significance of making sure the appraiser gives the property’s features, such as the exact square footage, the number of bedrooms, and any upgrades, due consideration.

Home improvements didn't increase the value as much as expected.

If you spend $100,000 installing a luxurious inground pool, for instance, that addition might encourage the buyer to make a higher offer.

However, if the appraiser determines that the pool only adds $20,000 to the home’s value, it can cause a discrepancy between the offer price and appraised value.

Don’t over-improve for the neighborhood is an adage we’ve all heard, and there is some truth to it.

No matter how much you’ve spent on upgrades, the appraiser will only offer you so much based on the nearby homes and comparables.

The Appraiser was under Time Constraints

Sometimes, a home’s valuation is determined to be lower than the sale price due to insufficient analysis.

An appraiser may be unable to locate the best comparable properties to compare your house to if they are pressed for time.

If you believe the appraiser did not consider all of the traits and attributes that could support a higher estimate, ask the lender for an appraisal review or reconsideration.

Always ensure the company you hire has the capacity to handle your file.

The appraiser lacks local expertise

If an appraisal is incorrectly low, it can be because the appraiser used subpar comparable sales data or simply lacked market knowledge.

Some banks will hire appraisers from outside the region who lack access to local sales information to save money, but sometimes the cost becomes expensive if the value isn’t correct.

In that situation, the appraiser is compelled to use information that was provided to them by other sources and may or may not be accurate.

Have your realtor give the appraiser a list of previously sold homes in your neighborhood comparable to yours and support your contract price at the appraisal appointment.

Your Home was Priced too High

When both the seller and the buyer decide to work without a real estate agent, appraisals frequently come in low.

In these situations, the seller may have inflated their home value above market value without the buyer seeing the disparity.

The sale price and market value are usually in line with whether the buyer or seller uses a Realtor® or an appraiser in their transaction.

How to Challenge an Appraisal

Does the deal end if your appraisal challenge fails, for example? No, not always.

About 75% of the time, appraisers can find a solution and finish the transaction when an appraisal is low. Here are several options for advancing the transaction:

The purchaser may cover the difference.

The seller may lower the price.

Together, the buyer and seller can reduce the difference.

The parties have the option to terminate the agreement.

When to discuss a guarantee for an evaluation gap

The Bottom Line

Appraisal discrepancies are less frequent in 2023’s real estate market than in the sellers’ market in 2020–2022.

When evaluating offers, sellers seek appraisal gap assurance clauses in strong markets where appraised values aren’t matching contract pricing.

A poor evaluation can be contested in writing, but you will need to provide evidence to support your claim.

The buyer may also choose to lower your price or pay the difference if the appraisal comes in below the agreed value.

Download your free

e-book today!

If you would like to download our ebook, simply sign up for our newsletter by filling out the form below.

- Marketwise Valuation Services, Inc.

- 7100 Biscayne Blvd, Suite 207

- (888) 602-9299

- appraisals@marketwisevaluation.com

- www.marketwisevaluation.com