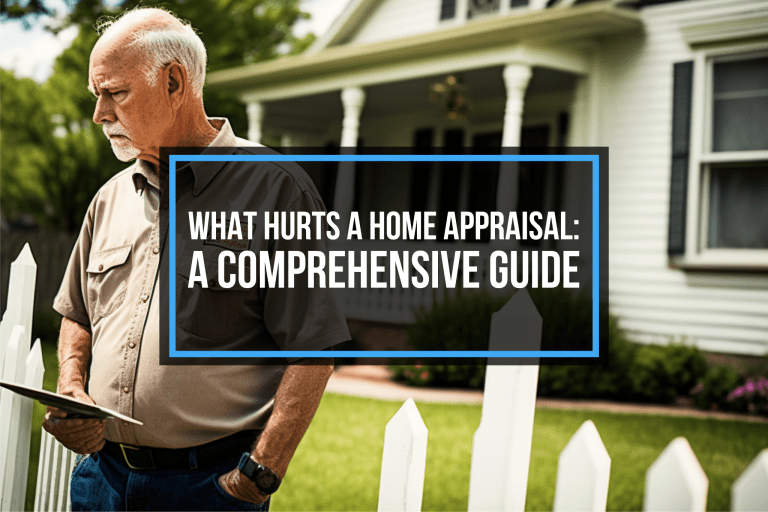

What Hurts a Home Appraisal: A Comprehensive Guide

A home appraisal is an essential part of the home buying or selling process. It helps to determine the market value of a property, which in turn helps buyers, sellers, and lenders to make informed decisions.

However, not all home appraisals go smoothly, and there are several factors that can negatively impact the appraisal value. In this article, we will discuss what hurts a home appraisal and how to avoid these pitfalls.

Understanding the Home Appraisal Process

Before delving into what can hurt a home appraisal, it is important to understand the home appraisal process. A home appraisal is conducted by a licensed professional appraiser who inspects the property and compiles a report on its value. The appraiser takes into account various factors, such as the size of the property, the location, the age of the property, the condition of the property, and the current real estate market conditions. The appraiser then uses this information to determine the estimated market value of the property.

What Hurts a Home Appraisal?

There are several factors that can hurt a home appraisal. Some of the most common factors include:

Poor Condition of the Property

The condition of the property is a significant factor that can impact its appraised value. If a home is in poor shape, with obvious signs of neglect like peeling paint, broken windows, or a leaky roof, it will generally receive a lower appraisal value. Appraisers consider a home’s interior and exterior conditions, including the foundation, roof, walls, floors, plumbing, electrical system, heating and cooling systems, and appliances. A home that is in poor condition will require significant repairs, and the cost of those repairs will be factored into the appraised value.

Location

The location of a property is another significant factor that can impact its appraised value. Appraisers typically consider factors like the home’s proximity to schools, parks, shopping centers, public transportation, and highways. Homes located in areas with high crime rates, poor schools, or a declining real estate market will generally receive a lower appraisal value. In contrast, homes located in desirable areas with low crime rates, good schools, and a stable real estate market will generally receive a higher appraisal value. Additionally, homes located in areas with high demand and limited supply will also receive a higher appraisal value.

Unpermitted Additions or Alterations

Unpermitted additions or alterations to a property can also lower its appraised value. If the appraiser discovers any unpermitted additions or alterations, they may not be included in the home’s square footage, reducing its overall value. Additionally, unpermitted additions or alterations may not meet local building codes or may not be up to current safety standards. The appraiser may also require the homeowner to remove any unpermitted structures, which can be expensive and time-consuming.

Personalized Features

Personalized features, such as custom paint or unusual flooring, can also impact a home’s appraised value. While these features may appeal to some buyers, they may not appeal to others, and as a result, they may lower the appraised value. Additionally, personalized features may be costly to remove or replace, which can further reduce the home’s overall value.

Lack of Up-to-Date Information

Finally, a lack of up-to-date information can hurt a home appraisal. Appraisers rely on accurate and up-to-date information to determine a home’s value. If the homeowner doesn’t provide the appraiser with information about recent renovations, upgrades, or repairs, the appraised value may be lower than it should be. Additionally, if the appraiser doesn’t have access to accurate information about the home, such as its age, condition, or square footage, they may make inaccurate assumptions, leading to an incorrect appraisal value. It’s essential to provide the appraiser with accurate and up-to-date information about the property to ensure a fair appraisal value.

The Bottom Line

A home appraisal is an important part of the home buying or selling process. Understanding what hurts a home appraisal and taking steps to avoid these factors can help ensure that the property receives an accurate and fair appraisal value. By maintaining the property, choosing a desirable location, avoiding unpermitted additions or alterations, keeping personalized features to a minimum, and providing the appraiser with accurate and up-to-date information, you can help ensure that your home appraisal goes smoothly and results in an accurate appraisal value.

FAQs

Q: What is a home appraisal?

A: A home appraisal is a professional evaluation of a property’s value, conducted by a licensed appraiser. The appraiser inspects the property, considers various factors such as location, condition, and market conditions, and compiles a report on the estimated market value of the property.

Q: What factors impact a home appraisal?

A: The condition of the property, location, unpermitted additions or alterations, personalized features, and a lack of up-to-date information are all factors that can negatively impact a home appraisal.

Q: Can the condition of the property lower the appraised value?

A: Yes, the condition of the property is a significant factor in determining the appraised value. If the property is in poor condition, with obvious signs of neglect, it will lower the appraised value.

Q: Does the location of the property affect the appraisal value?

Yes, the location of the property plays a significant role in determining the appraised value. Properties located in desirable areas with good schools, low crime rates, and a stable real estate market will receive a higher appraisal value, while properties located in areas with high crime rates, poor schools, or a declining real estate market will receive a lower appraisal value.

Q: Can unpermitted additions or alterations lower the appraised value?

Yes, unpermitted additions or alterations can lower the appraised value as they may not meet local building codes or may not be up to current safety standards. If the appraiser discovers any unpermitted additions or alterations during the appraisal process, the appraised value of the property may be lowered.

Download your free

e-book today!

If you would like to download our ebook, simply sign up for our newsletter by filling out the form below.

- Marketwise Valuation Services, Inc.

- 7100 Biscayne Blvd, Suite 207

- (888) 602-9299

- appraisals@marketwisevaluation.com

- www.marketwisevaluation.com