OVerview

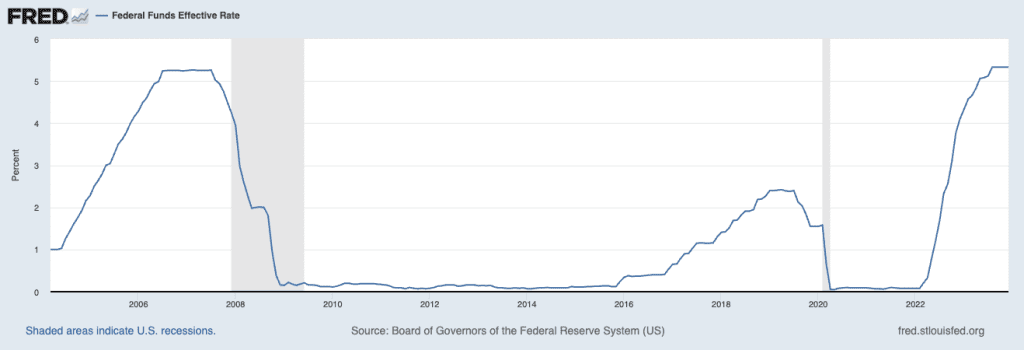

The global economic landscape in Q4 2023 was shaped by the interplay of predictable macroeconomic cycles and modern monetary theories. Despite expectations of a demand slowdown, the broader economy remained resilient, with Federal Reserve Chairman Jerome Powell indicating a potential peak in policy tightening. This was reflected in the Fed’s decision to maintain interest rates, projecting a federal funds rate of 4.6% by the end of 2024, contrary to investors’ expectations of more significant cuts.

Domestically, the U.S. economy showed mixed signals: a decrease in unemployment to 3.7% and a robust 5.2% GDP growth rate juxtaposed against a backdrop of high inflation and its disproportionate impact on lower-income earners. Internationally, geopolitical tensions were heightened by ongoing conflicts in Ukraine and between Israel and Hamas, contributing to global instability and impacting the U.S. both financially and militarily.

Despite the prevailing negative economic perceptions and geopolitical concerns, there were signs of optimism. Inflationary pressures began to ease, with significant drops in crude oil prices leading to lower gasoline costs. The bond and mortgage markets reacted positively to the Fed’s anticipated rate cuts in 2024, indicating a potential easing of monetary policy. This trend, coupled with the need for continued downward inflation for the Fed to achieve its soft landing target, suggests a cautiously optimistic outlook for the economy.

Macroeconomics

Recent economic forecasts present a cautiously optimistic view of the U.S. economy’s trajectory. The Federal Reserve Bank of Philadelphia’s survey of 34 economists predicts a slight uptick in economic growth, expecting a 1.3% annual rate in the current quarter. Atlanta’s GDPNow model aligns with this positive shift, projecting a 2.6% real GDP growth in Q4 2023, an improvement from earlier estimates. This outlook is supported by increased projections in personal consumption expenditures, private domestic investment, and government spending, indicating a resilient economy despite earlier recession concerns.

The economic outlook for 2023-2024, however, remains cautiously optimistic with several potential challenges. Inflation, while on a downward trend, has not yet reached the desired levels, prompting the Federal Reserve to consider further monetary tightening. Long-term interest rates have only recently begun to reflect the impact of past tightening measures. The US budget process is fraught with uncertainty, posing risks to economic stability. Additionally, geopolitical tensions and supply chain disruptions, particularly in oil, continue to threaten economic growth.

Deloitte’s analysis suggests a baseline economic growth of around 1.5% to 1.6% by 2025, with inflation easing below 3%, indicative of a potential “soft landing.” This scenario anticipates a stable job market, albeit with a slowdown in job creation. Despite slower growth in key global economies and challenges like higher energy costs and a strong dollar, a recession seems unlikely. However, certain sectors may face difficulties; consumer durables and housing are expected to decline due to high interest rates and market saturation, while nonresidential construction lags due to excess space. Conversely, investments in manufacturing infrastructure, like chip plants and alternative energy projects, could offset some of these declines.

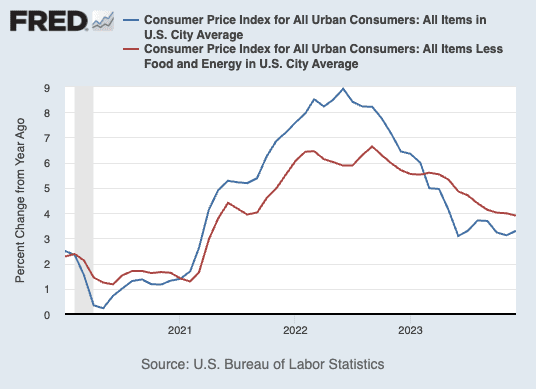

Inflation

In November, the consumer price index (CPI), a crucial inflation indicator, reported a modest 0.1% rise, marking a 3.1% increase from the previous year. Core CPI, excluding volatile food and energy sectors, climbed by 0.3% monthly and 4% annually. This overall inflation rate was tempered by a significant 2.3% fall in energy costs, with gasoline and fuel oil prices dropping by 6% and 2.7%, respectively. However, food costs saw a marginal increase of 0.2%. Liz Ann Sonders of Charles Schwab viewed the report as somewhat anticipated, noting it wasn’t as encouraging as hoped regarding a quicker monthly decline in inflation. She anticipates the Federal Reserve will continue focusing on the positive aspects of ongoing disinflation.

Housing expenses, comprising about a third of the CPI, increased by 0.4% monthly, showing a 6.5% rise over the year. This annual rate has been declining since early 2023, with non-home accommodation costs dropping by 0.9%. The Fed, having raised interest rates 11 times since March 2022, faces market expectations of no further hikes, with a potential rate cut as early as May. Futures markets predict a significant easing by the Fed in 2024, with potential rate reductions totaling up to 1.25% by the end of the year.

Microeconomics

In the third quarter of 2023, U.S. household debt saw a significant increase, rising by $228 billion to a total of $17.29 trillion, marking a $3.1 trillion growth since late 2019. This rise reflects the evolving economic landscape in the post-pandemic era. The breakdown of this debt includes a $126 billion increase in mortgage balances, reaching $12.14 trillion, and growth in home equity lines of credit to $349 billion. Additionally, credit card debts rose by 4.7% to $1.08 trillion, and auto loan balances continued their upward trajectory since 2011, reaching $1.6 trillion. Other consumer loans and student loan debts also saw increases, with the latter climbing by $30 billion to $1.6 trillion.

Despite the overall increase in debt, mortgage originations in Q3 2023 declined to $386 billion, lower than previous quarters and significantly below the levels seen in 2020-2021. Credit card limits experienced a 2.5% increase, while the credit quality for new loans remained stable. However, aggregate delinquency rates rose to 3.0%, with noticeable increases in credit card and auto loan delinquencies, especially among borrowers aged 30-39. Mortgage delinquency rates also saw a slight increase. In contrast, foreclosure notations slightly decreased, with about 36,000 new cases, and student loan delinquencies remained exceptionally low, largely due to current policies.

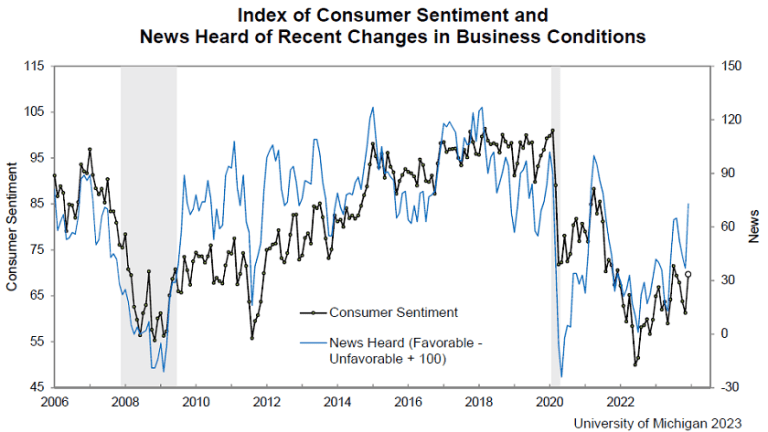

Consumer sentiment in December experienced a remarkable 14% increase, recovering from declines in the previous months, largely due to improved perceptions of inflation. This uplift was consistent across various demographics, bringing the sentiment index closer to its pre-pandemic level. Inflation expectations significantly shifted, with year-ahead projections dropping to the lowest since March 2021 and long-term inflation expectations decreasing to 2.9%. However, these long-term expectations remain higher than pre-pandemic levels, indicating a continued cautious outlook on inflation over the long run.

Residential Real Estate

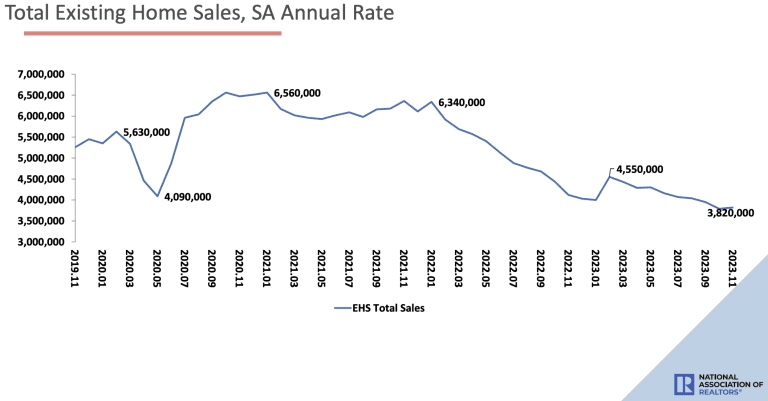

In 2023, the real estate market faced volatility, with low housing inventory driving up prices, challenging both buyers and sellers. Entering 2024, signs of stability emerge. The last quarter of 2023 witnessed a 6.3% year-over-year increase in housing prices and a surge in mortgage rates, leading to a decline in existing home sales. However, new home sales rose, aided by builder adaptations like price concessions and smaller homes. Interest rate adjustments by the Federal Reserve spurred an increase in housing starts and mortgage applications.

Market dynamics were influenced by expectations around Federal Reserve interest rate policies and U.S. economic factors. The widening mortgage spread, exacerbated by political uncertainties, affected borrowers. Despite calls for policy adjustments, the Federal Reserve continued its Quantitative Tightening, impacting mortgage rates and the lending landscape.

November 2023 data showed new single-family home sales at a seasonally adjusted annual rate of 590,000, a 12.2% decrease from October but up 1.4% year-over-year. The median sale price was $434,700, with an average of $488,900. The market ended with a 9.2-month supply of new houses, indicating a gradually easing but still tight market.

Commercial Real Estate

In 2023, the U.S. economy demonstrated signs of stabilization, with inflation returning to 2019 levels and a strong job market, evidenced by an unemployment rate of 3.7% and robust consumer spending. Despite initial recession fears, the economy remained resilient, and the Federal Reserve signaled a possible slowdown in rate hikes. The general consensus now suggests a “soft landing” for the economy, as it undergoes a corrective course.

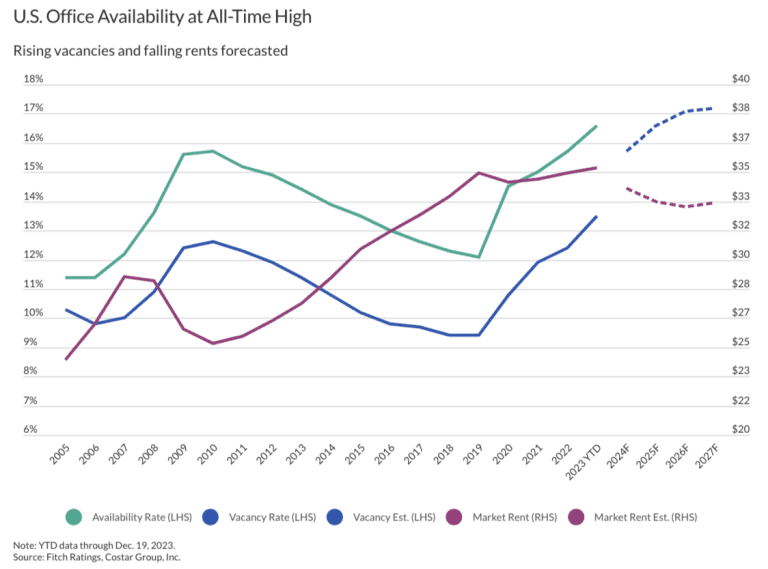

The housing market, particularly in the apartment sector, saw a decline in the last quarter of 2023. The decrease in new apartment occupancies was attributed to the “locked-in” effect, where people stayed in their current homes due to high rent costs, challenging the formation of new households. Meanwhile, office spaces witnessed record vacancy rates of 19.6%, the highest since the 1980s, driven by changes in work habits. However, in contrast, South Florida saw growth in office projects, and New York City focused on office-to-residential conversions. The retail sector remained stable with unchanged vacancy rates and a slight increase in rents, highlighting the continued importance of physical stores despite the rise of online shopping.

The industrial sector, driven by online shopping and manufacturing shifts, expanded rapidly but faced a slowdown in construction and new building completions by late 2023, indicating a move towards a more balanced market. Overall, Q4 2023 is expected to show a softening in commercial real estate (CRE) debt origination and transactions, with a cautious outlook for the next year. High interest and capitalization rates are affecting asset valuations and increasing refinancing risks, leading to a stable or slightly negative outlook in ratings, particularly within the speculative-grade category.

COnclusion

The U.S. economy in 2023 displays a cautiously optimistic macroeconomic landscape, underpinned by modest improvements in GDP growth as indicated by surveys from FED Philadelphia and Atlanta FED’s GDPNow. Despite facing challenges like inflation, interest rate dynamics, budget uncertainties, and geopolitical tensions, the economy is poised for a “soft landing” by 2025. This trajectory suggests steady growth with manageable inflation, although sectors like consumer durables and housing may encounter headwinds. Microeconomically, the U.S. has witnessed a rise in household debt to $17.29 trillion, with increases in mortgages, credit cards, and auto loans reflecting a broader trend in consumer borrowing. Stability in credit quality and low delinquency rates, coupled with a resilient housing market and effective federal policies on student loans, point towards a stabilizing microeconomic environment.

2023 was marked by volatility in the residential real estate sector, with challenges arising from low inventory and high prices. However, the year ended with signs of market stabilization, driven by a rise in new home sales, adaptive strategies by builders, and the Federal Reserve’s rate adjustments. The commercial real estate sector, meanwhile, experienced varied fortunes: high vacancy rates in the office sector due to evolving work habits, a stable retail market emphasizing the continued importance of physical stores, and a cooling industrial sector reflecting a shift towards market equilibrium. These developments in both residential and commercial real estate reflect the broader economic trends, signaling a period of neutral stability with a cautiously optimistic outlook for the coming year, characterized by a potential softening in real estate debt origination and transactions, and a stable to slightly negative outlook on ratings.

INterested in custom industry reporting for your institution? Enter your information below to learn more.

- Marketwise Valuation Services, Inc.

- 7100 Biscayne Blvd, Suite 207

- (888) 602-9299

- appraisals@marketwisevaluation.com

- www.marketwisevaluation.com