Don’t Fear the Upcoming Recession, it’s Our Only Way Back to Normal.

Don’t Fear the Upcoming Recession, it’s Our Only Way Back to Normal

Home prices are screaming for relief and the Fed is granting the wishes of so many who’ve found themselves priced out of the housing market. Part of the American dream is homeownership, something that’s in jeopardy of being out of reach for many Americans.

Shiny Cars Need Maintenance Too

Five in six months. If the Fed’s going for a record, they might have done it. September’s FOMC Fed Funds rate hike marks the latest installment in the David vs. Goliath fight against inflation. In my last writeup, I made it clear that the firemen helped fuel the very fire they’re currently at war with. We’re in for a wild ride over the next twelve months watching the effects of fast-changing monetary policy play out in real-time.

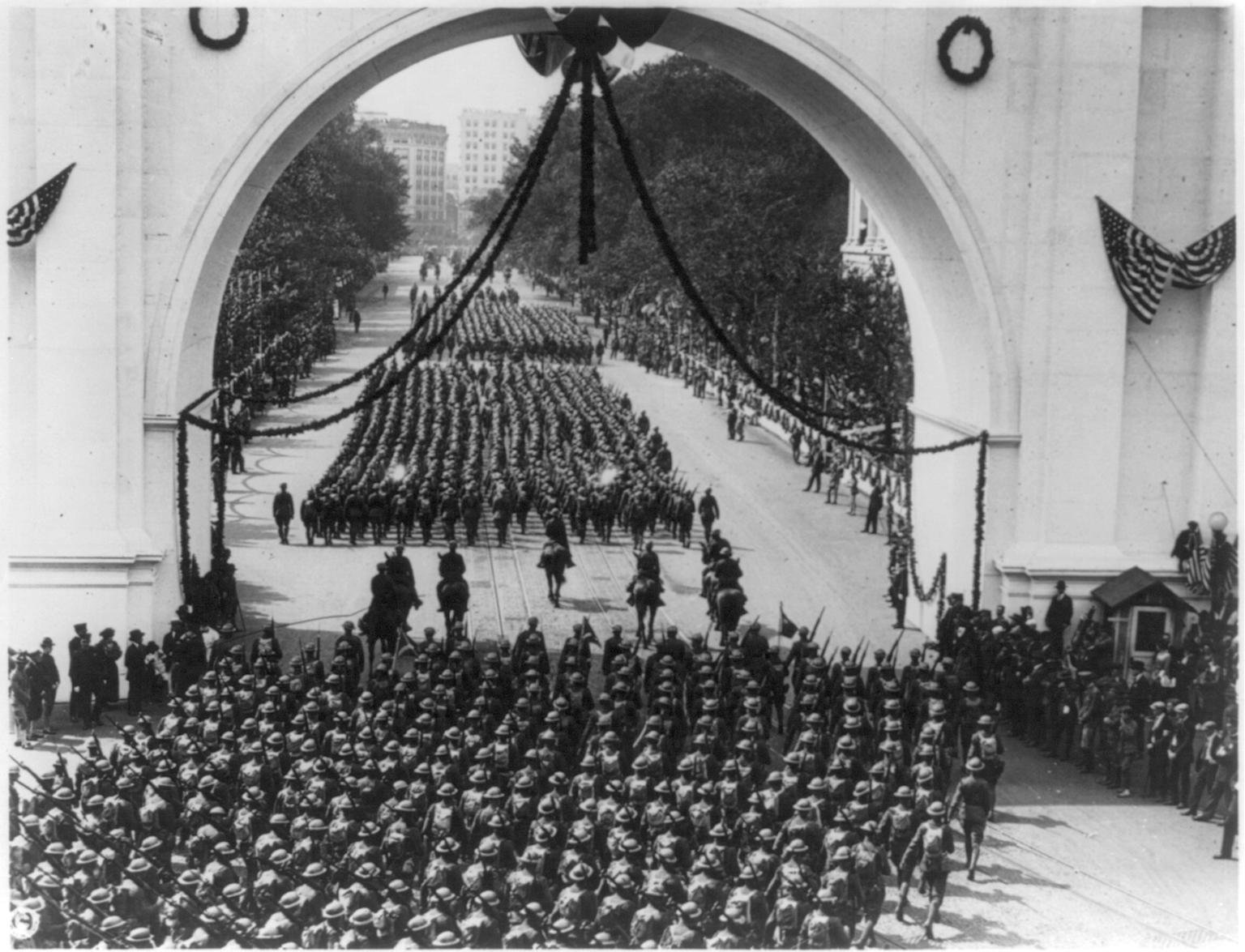

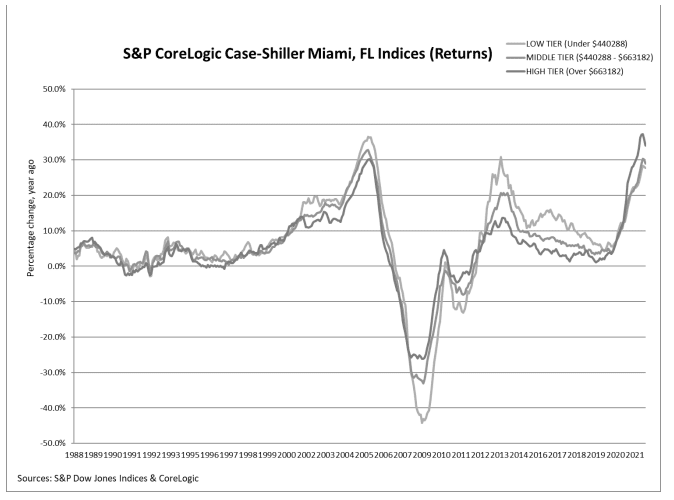

September was a hopeful month for investors. Many expected CPI to print around 8% YoY and below 6% for the Core reading. Gas and broader energy prices wowed the Street with a massive 10%+ drop MoM due to easing of commodity prices off the heels of Russia’s War in Ukraine. Shelter prices stole the show with a huge 0.7% MoM increase – you can thank the red hot housing market for that. Prices in some markets have jumped 40%+ in the past 24 months due to COVID’s migration patterns into the Sunbelt region of the US.

The question on everyone’s mind is….what’s next? There’s an absurd amount of speculation in the markets owing to future uncertainty. Pundits and the 24-hour news cycle are scratching their heads unable to articulate the reality of what’s to come. The truth can be frightening or liberating, depending on how it plays out. Truthfully, I see the clear path ahead on a high level and much less clear while trying to fill in the details.

Check, Please.

Global panic and frozen capital markets in March 2020 caused governments and central banks to drop the hammer. Stimulus, direct aid, and asset purchases all got called to the starting line and worked spectacularly to keep the economy shiny and employed. Why look below the hood if the engine sounds so good?

All parties come to an end and the check always comes due before you can leave. That brings us to where we are now, in September 2022. Chair Powell announced, with the utmost conviction, his willingness to stop inflation in its tracks. “A failure to restore price stability would lead to greater pain later on,” Mr. Powell said. Reading between the lines is a clear message to the country that a wild ride is ahead. Fed Funds Rates are expected to hit 4.4% by the end of the year, and 4.6% by the end of 2023.

Key Developments

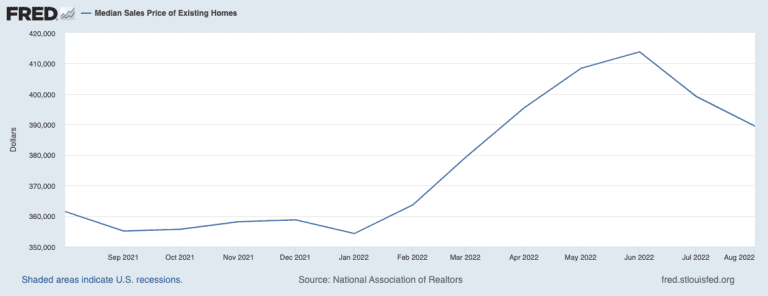

- The average 30-year mortgage interest rate as of September 24th is 6.25%, up 325 bps from the same period last year

The median US home price sold in August 2022 was $389,500, up 7.75% YoY

The average 30-year fixed rate mortgage is up 107% YoY

The median home mortgage payment is up 57.17% YoY

Purchasing Power based on median home sales price is down 50.4% YoY

Ouch, That Sounds Painful.

Well, yes, it does sound painful. For instance, let’s dive into a hot-button issue, the housing market. If you were to try and buy a home in August 2022 with a 10% Down 6.25% 30 yr fixed interest rate, the median price was $389,500. Your P+I payment would have been $2,158.

Rewind 12 months to August 2021.

If you were to try and buy a home in August 2021 with a 10% Down 3.01% 30 yr fixed interest rate, the median price was $361,500. Your P+I payment would have been $1,373. Over the past twelve months, your payment has gone up 57.17%.

Holding wages steady, that same buyer could have qualified for a $570,000 purchase in August 2021. That’s a MASSIVE 50.4% reduction in purchasing power YoY. Simple supply and demand economics suggest that a population whose median income has only risen around 8% YoY can’t possibly keep up with price and interest rate advances. Supply issues have helped to drive prices, but that excuse can only account for so much now that interest rates are in the sixes.

Home prices are screaming for relief and the Fed is granting the wishes of so many who’ve found themselves priced out of the housing market. Part of the American dream is homeownership, something that’s in jeopardy of being out of reach for many Americans.

Should we Fear the Recession?

Below is an excerpt from a post by Morgan Stanley, written by their Chief Investment Officer Lisa Shallet:

“If history is any guide, an inflation-triggered recession would be less severe than one caused by credit excesses.”

Beyond historical trends, several economic factors point to a less severe recession, should one come to pass:

- The housing and auto industries are strong. Housing prices have been high and resilient, while inventories are tight and could fall even further with higher interest rates. For autos, production rates are below prior peaks due to semiconductor shortages. As supply chains clear, order backlogs could keep manufacturing activity uncharacteristically high for a recession.

- Labor-market dynamics remain robust. Not only is the labor market tight, as defined by unemployment rates, but it also shows record-high ratios of new job openings to potential applicants. This suggests that, rather than laying off current employees, companies may first reduce their open job postings, potentially delaying the hit to unemployment.

- Balance sheets are in the best shape in decades across households, companies, and the banking system. Moreover, catalysts for corporate capital spending appear strong, given current needs around energy infrastructure, automation, and national defense that are not directly linked to the business cycle or the Fed’s actions.

- Corporate revenues may be more durable. Today’s stock-index composition shows a growing share of earnings attributed to recurring revenue streams, as more companies build subscription- and fee-based models.

Good News on the Horizon

In many markets across the country, we’re seeing signs of deflation in the housing market. FRED’s August data showed that the median sales price of a home in the US was $389,500, down 5% from June’s high of $410,000.

Median home price deflation is a GOOD thing considering so many have been hopelessly priced out of the market. Without a stabilized housing market, speculative price growth is a risk to economic conditions as a whole – see 2009 as a tidy example.

Interest rates will continue to rise until all sector demand is depressed enough to kick us into a recession. Only then will we have the opportunity to kill inflation for the time being and normalize our anything-but-normal economy.