A retrospective look at q2

The second quarter in 2022 was the beginning of a pivot in the macroeconomic outlook of this country with broad implications for the future of the real estate market. It looks like we’re heading into a protracted period of uncertainty – one that Jamie Dimon of Chase Bank called an upcoming “hurricane” of economic condition. Uncertainty can mean many things, but the most likely outcome is a period of economic contraction due to the breakaway growth of the past two and a half years.

Q2 2022 saw capital and equity markets experience a global contractionary period; a reaction to the period of liberal monetary policy initiated during the COVID-19 pandemic which began in March 2020. All economic participants experienced a steep and violent economic contraction due to the uncertainty related to the pandemic. As a result of unprecedented global lockdowns and travel restrictions, the world recoiled in horror on an economic and philosophical level.

Economic actors across the world were deeply concerned with preserving liquidity in the face of such uncertain economic conditions. Capital markets briefly froze along with a steep decline in global equities markets. In response, central banks reacted quickly to stop the bleeding.

Central banks instituted policies immediately following the declarations of pandemic-related emergencies to combat the prevailing mood of fear and restart economic activity. The US Federal Reserve cut the target Federal Funds Rates, the rate at which banks borrow from one another to a range of 0-0.25% on March 15th, 2020. Quantitive Easing programs were restarted, targeting broad-ranging actions as a reaction to dysfunctional credit markets. The US economy eventually returned to full employment and experienced a robust expansion on all fronts between late 2020 and mid-2022; growth was most notable in real estate and equities markets due to historically low-interest rates and low-cost debt.

"A consequence of the prolonged period of liberal fiscal and monetary policies is near-record levels of inflation."

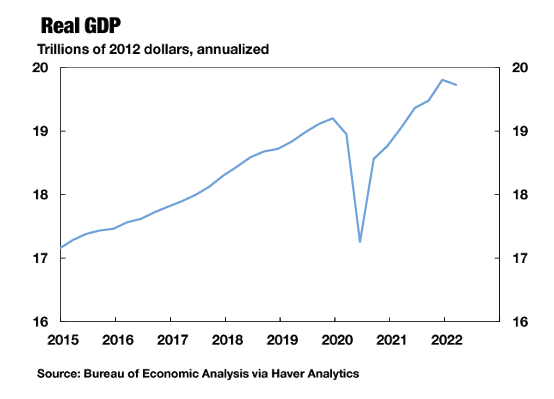

Q1 2022 began to show a macroeconomic slowdown in the US economy, as measured by GDP at an annualized rate. According to the US Bureau of Economic Analysis, real GDP decreased 1.4% on an annualized basis, marking the first decrease since the beginning of the COVID-19 pandemic. Q2 2022 marked another volatile period across equity markets with the Dow Jones Industrial Average declining over 20% off of all-time highs in Q4 2021.

Supply-side issues persisted in Q2, made worse by constricted supply chains worldwide. Mckinsey’s research cites three persistent supply chain issues: labor shortages, equipment shortages, and the ripple effect of global bottlenecks. The War in Ukraine caused shipping delays and food shortages which could get worse, as Ukraine supplies 29% of global wheat production. China’s “zero-COVID” policy has caused regional shutdowns in several provinces and major ports, further delaying factory production and supply chain logistics.

macroeconomic overview

On March 26th, 2022, The Federal Reserve marked a reversal in its monetary policy by increasing the target federal funds rate by 25bps, citing historic inflation levels. The decision by the Fed to raise the federal funds rate was the first move to do so since 2018. On May 4th, 2022, The Fed’s Open Market Committee reaffirmed the bank’s aggressive posture on inflation targets. Chairman Powell announced a 50 bps hike in the target federal funds rate with commentary indicating sequential 50 (or more) bps rate hikes would follow: “in support of these goals, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee decided to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1.”

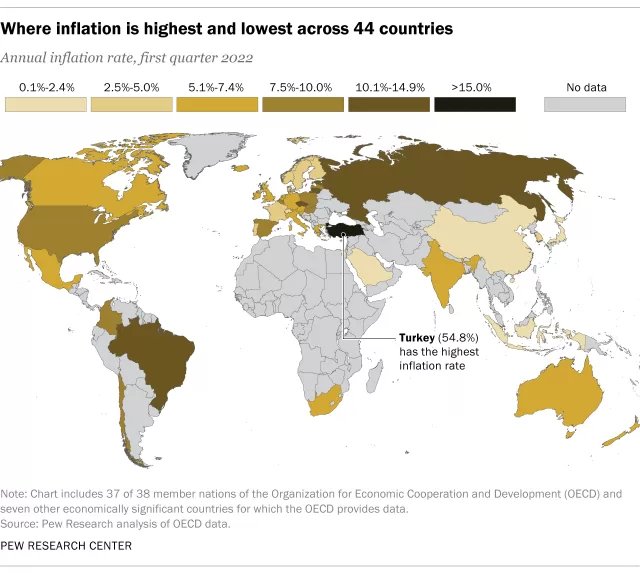

inflation

May 2022’s inflation data published by the Bureau of Labor Statistics in June point to increased volatility, slightly above consensus estimates. US Inflation data increased 8.6% annually and increased 1% month over month led by energy, food, and housing costs. Continual advances in inflation will likely press the Federal Reserve and US Government to continue tightening monetary policy in an attempt to tamp inflation down to target levels.

Q2 GDP

The March Blue Chip Survey predicts average annual growth between 2024-2028 at 2% annually. GDP has grown at an annual rate of 1.2% since Q4 2019. GDP growth appears to be returning to the longer-term growth forecast, and below pre-pandemic trend levels.

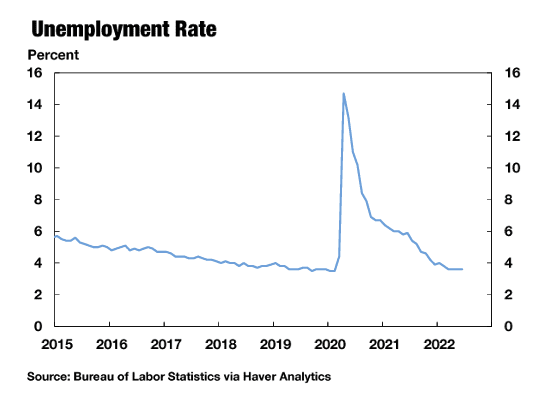

National Unemployment

The US Bureau of Labor Statistics reports that the national unemployment was 3.6% in April, down 2.4% from the same period 12 months ago. Strong economic growth has driven the economy to full employment. As of May, the number of unemployed persons was essentially unchanged at 5.9 million. These measures are little different from their values in February 2020 (3.5 percent and 5.7 million, respectively), before the coronavirus (COVID-19) pandemic.6

Overall, unemployment remains low throughout Q2, at or below the natural level of unemployment. However, future threats to unemployment include unknown fiscal and monetary policy decisions that could be implemented to combat inflationary pressures.

Inflation-adjusted average hourly earnings fell 3% in May from a year earlier, the biggest drop since April 2021 and the 14th straight decline, separate data showed in June’s CPI figures.

Outlook

I’ll write again next month once we’re wrapped up with September with my thoughts on this current quarter. So far we’ve seen mixed economic indicators that haven’t changed my outlook to any significant degree. Technically, the economy is in a recession if you judge by the classic metric of two consecutive quarters of GDP contraction. Q1 and Q2 2022 both saw the economy contract on an annualized basis while nearly every other indicator contradicted it.

We wouldn’t be writing about a recession if it was so cut and dry. The truth is that economists are undecided, and it sure doesn’t look like a recession if you account for unemployment and job numbers. In August, we’re sitting at 3.7% unemployment (a 50-year low) with jobless claims at a moderately low, but increasing rate.

I’m taking a very realistic view of the situation that’s unfolding. COVID-19 supply-chain issues exacerbated existing supply bottlenecks, with the cherry on top being record-low interest rates. The Fed backed itself into a corner with 24 months of aggressive posturing and pandora’s box is open.

An unprecedented economic storm is brewing. Powell and co. have signaled a turn toward more hawkish policy until inflation is back to 2% target rates. Until then, monthly CPI numbers, jobless claims, and the unemployment rate will serve as crystal balls for those inclined to try and predict the future.

Don't Miss Out. Join Our Newsletter Today!

- Marketwise Valuation Services, Inc.

- 7100 Biscayne Blvd, Suite 207

- (888) 602-9299

- appraisals@marketwisevaluation.com

- www.marketwisevaluation.com